Debt Capital Markets

Streamline debt portfolio management by digitizing agreements and automating funding requests. Maximize capital efficiency with borrowing base optimization, enhance securitization reporting, track covenant triggers, and access detailed analytics including borrowing base trends and vintage curves.

Debt Capital Markets (DCM)

Streamlined Debt Portfolio Management, Borrowing Base Optimization, And Securitization Analytics

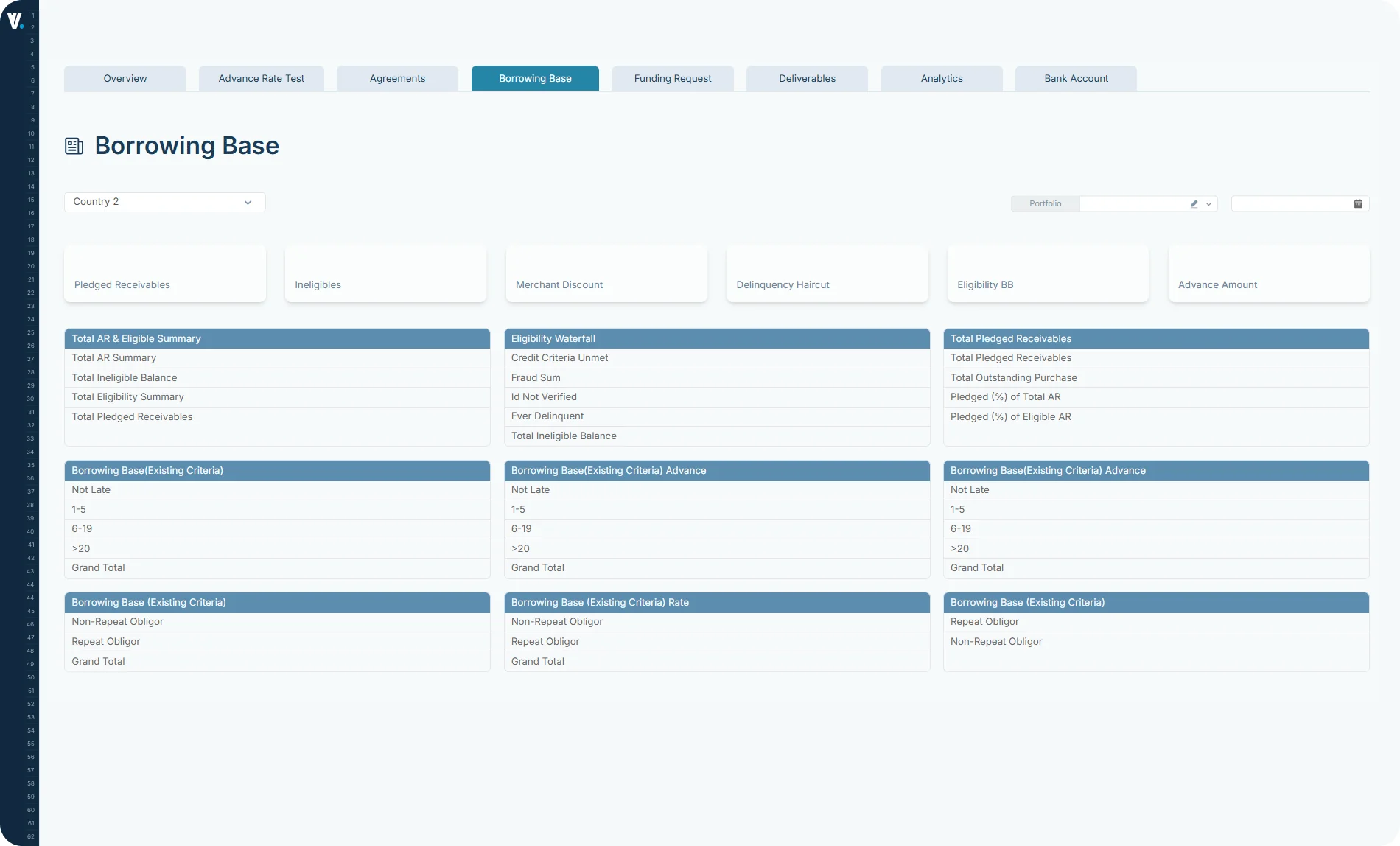

Instant Borrowing Base

Real-time calculation of available capacity

Automated Assignment

Streamlined receivable allocation and tracking

Collateral Validation

Instant eligibility checks and compliance

Lender Integration

Direct submission to funding partners

Transform Your Capital Markets Operations

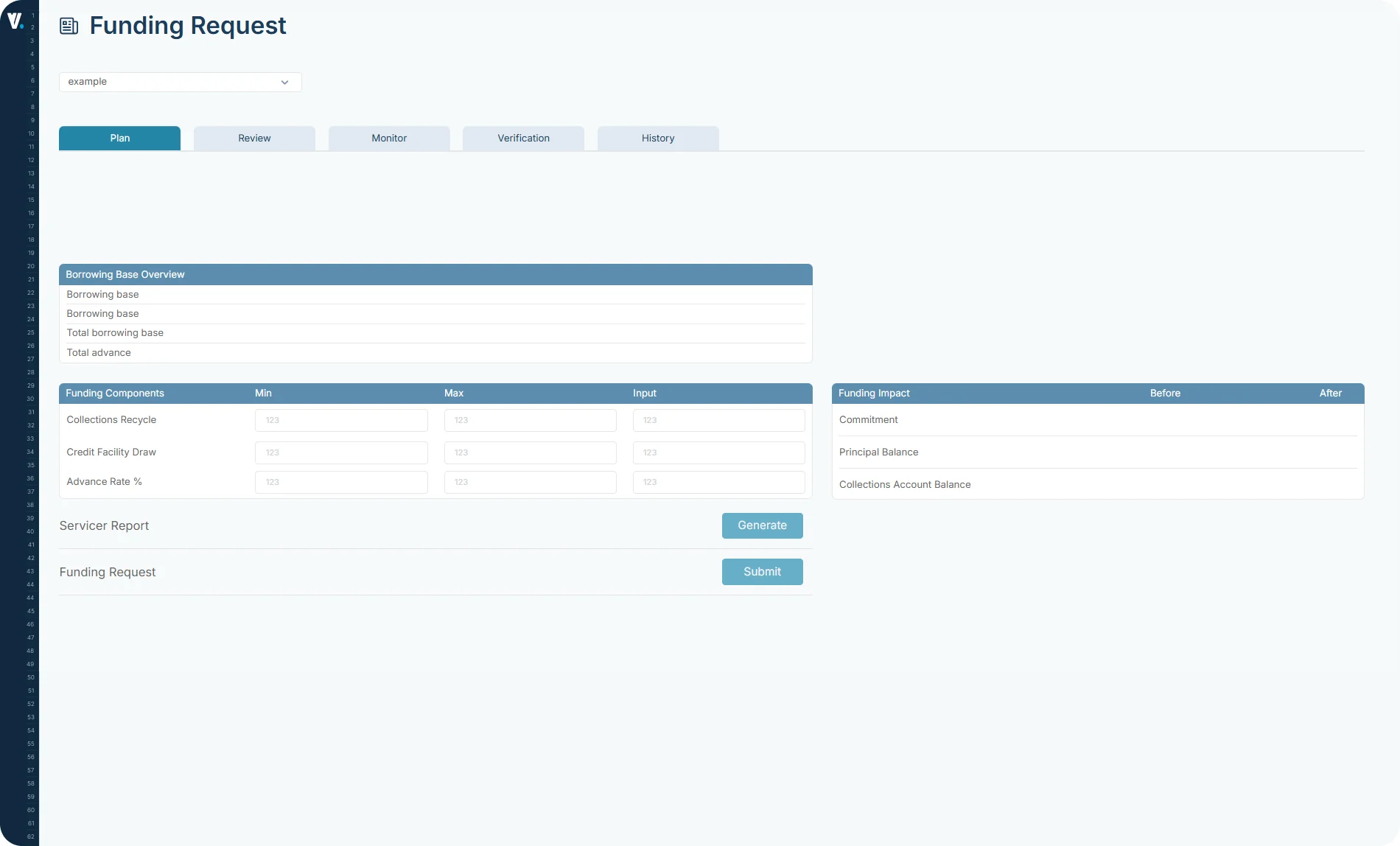

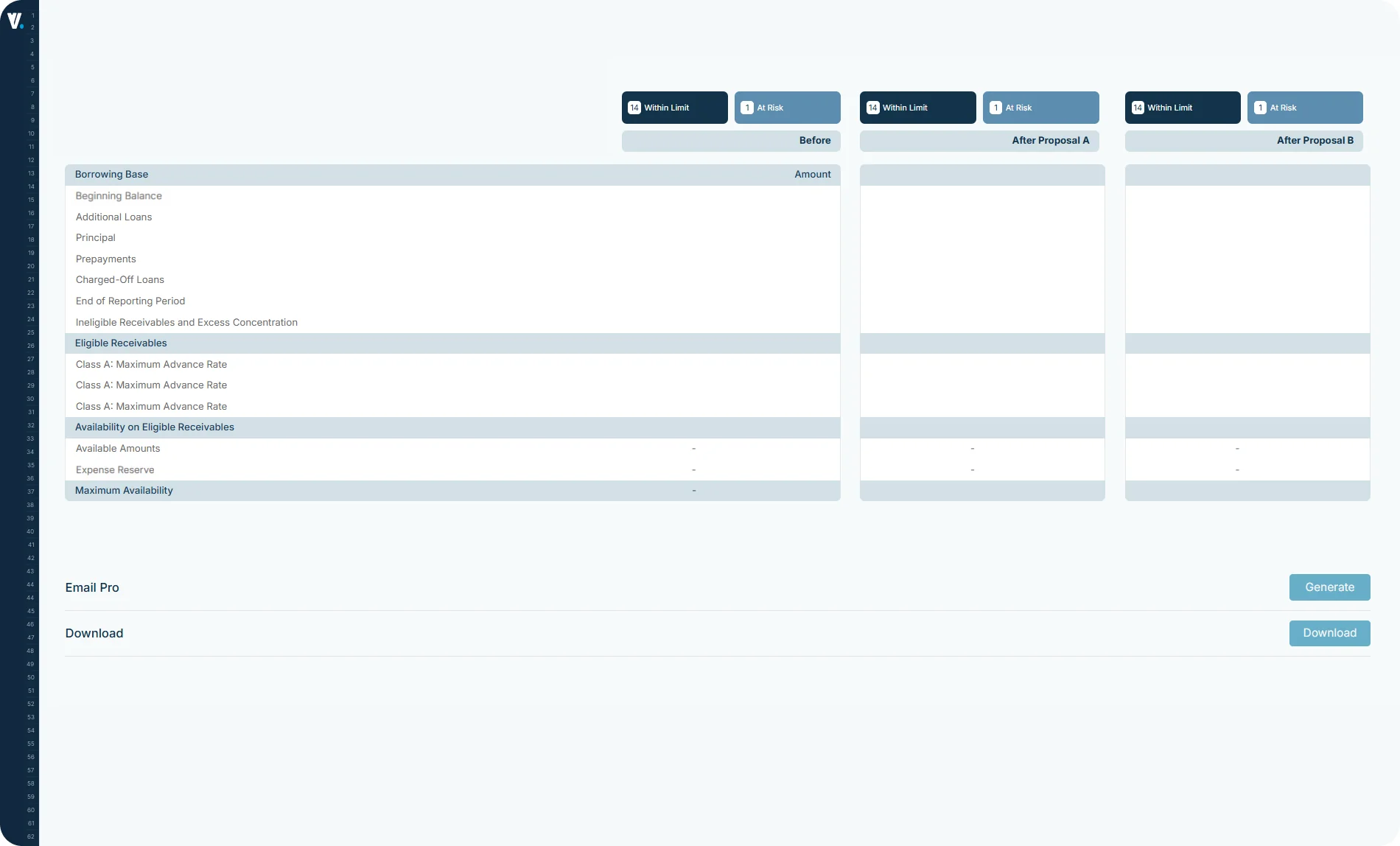

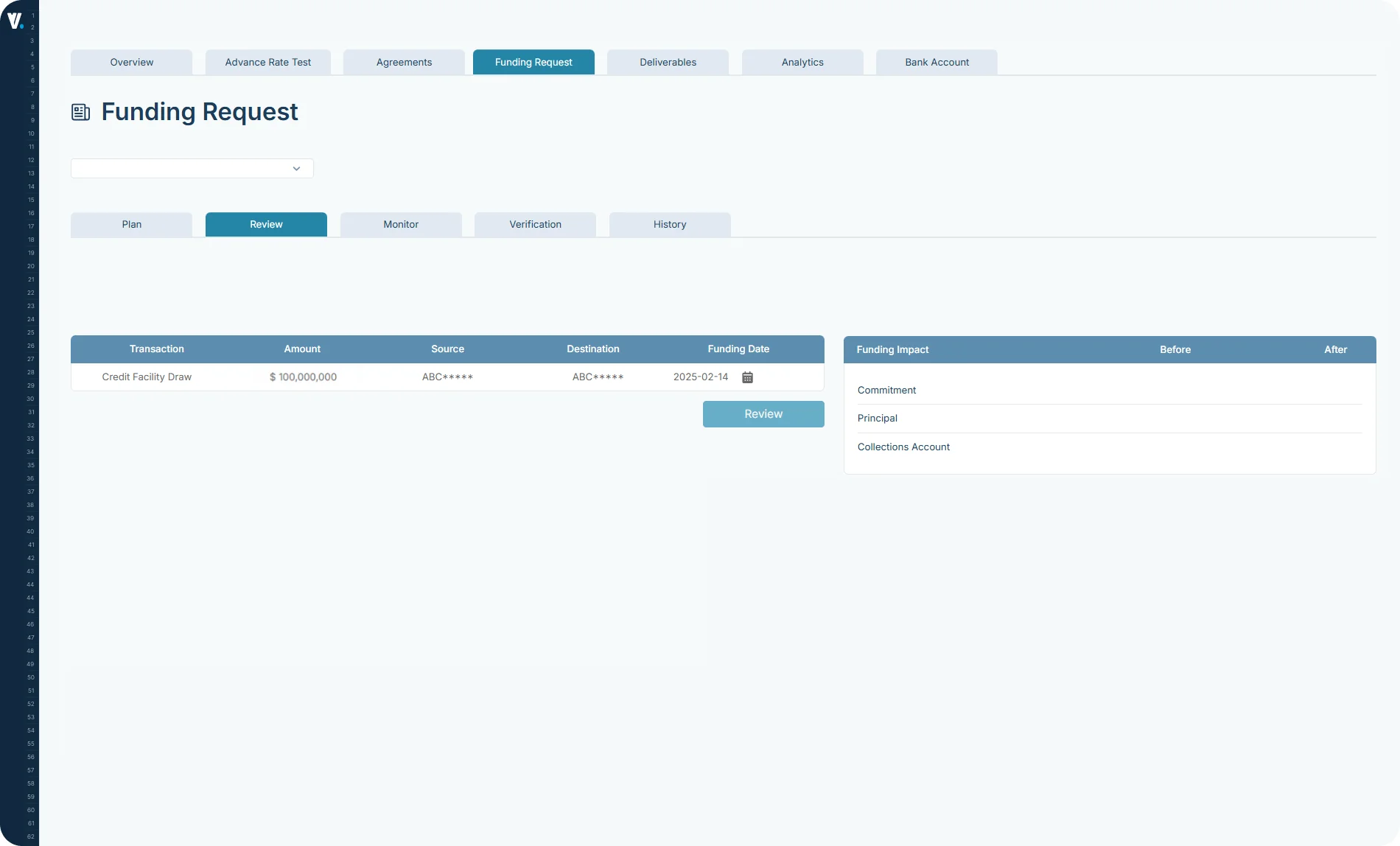

Automate your funding request workflow from receivable assignment to lender notification. Our intelligent system instantly calculates borrowing base, validates collateral, and generates funding requests—reducing manual work by 90% while eliminating errors.

Eliminate Manual Errors

Automated validation ensures 100% accuracy in borrowing base calculations and receivable assignments, removing costly mistakes.

Accelerate Cash Flow

Reduce funding request turnaround from days to minutes, unlocking working capital faster and improving liquidity management.

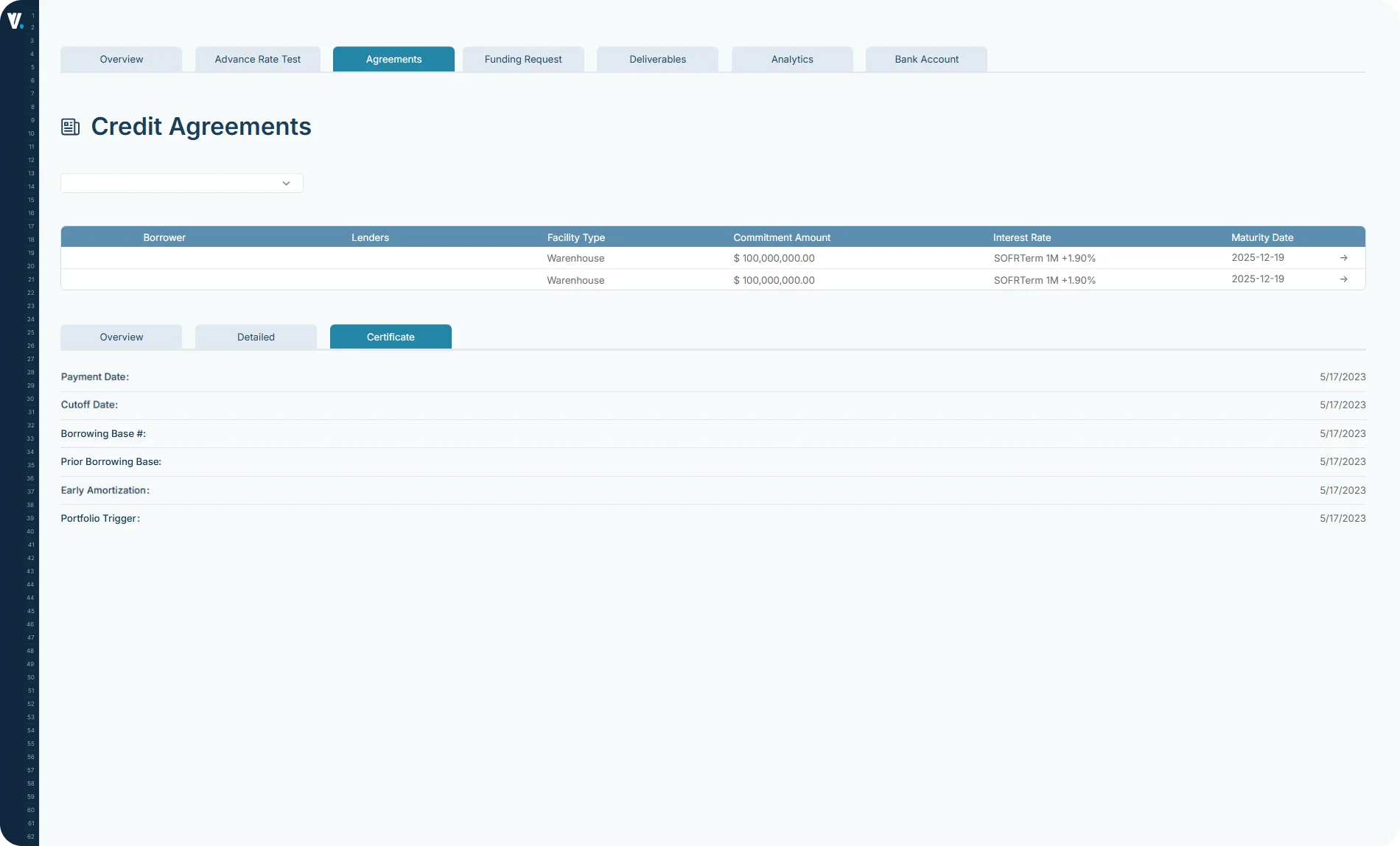

Enhance Lender Relationships

Provide lenders with clean, verified data packages that build trust and facilitate faster approvals.

Scale Operations Efficiently

Handle growing transaction volumes without adding staff, maintaining consistent quality as your business expands.

Real-Time Visibility

Monitor borrowing capacity, utilization rates, and collateral status in real-time dashboards for proactive decision-making.

Audit-Ready Documentation

Maintain complete audit trails of all funding requests, assignments, and approvals for regulatory compliance.