Credit Risk Analytics & Reporting

Assess and manage credit risk with tools that help banks mitigate losses and comply with CECL and IFRS 9 standards. Model expected credit losses, support financial projections for loan portfolios, and enable data-driven decisions with optimized credit risk strategies.

Credit Risk Analytics

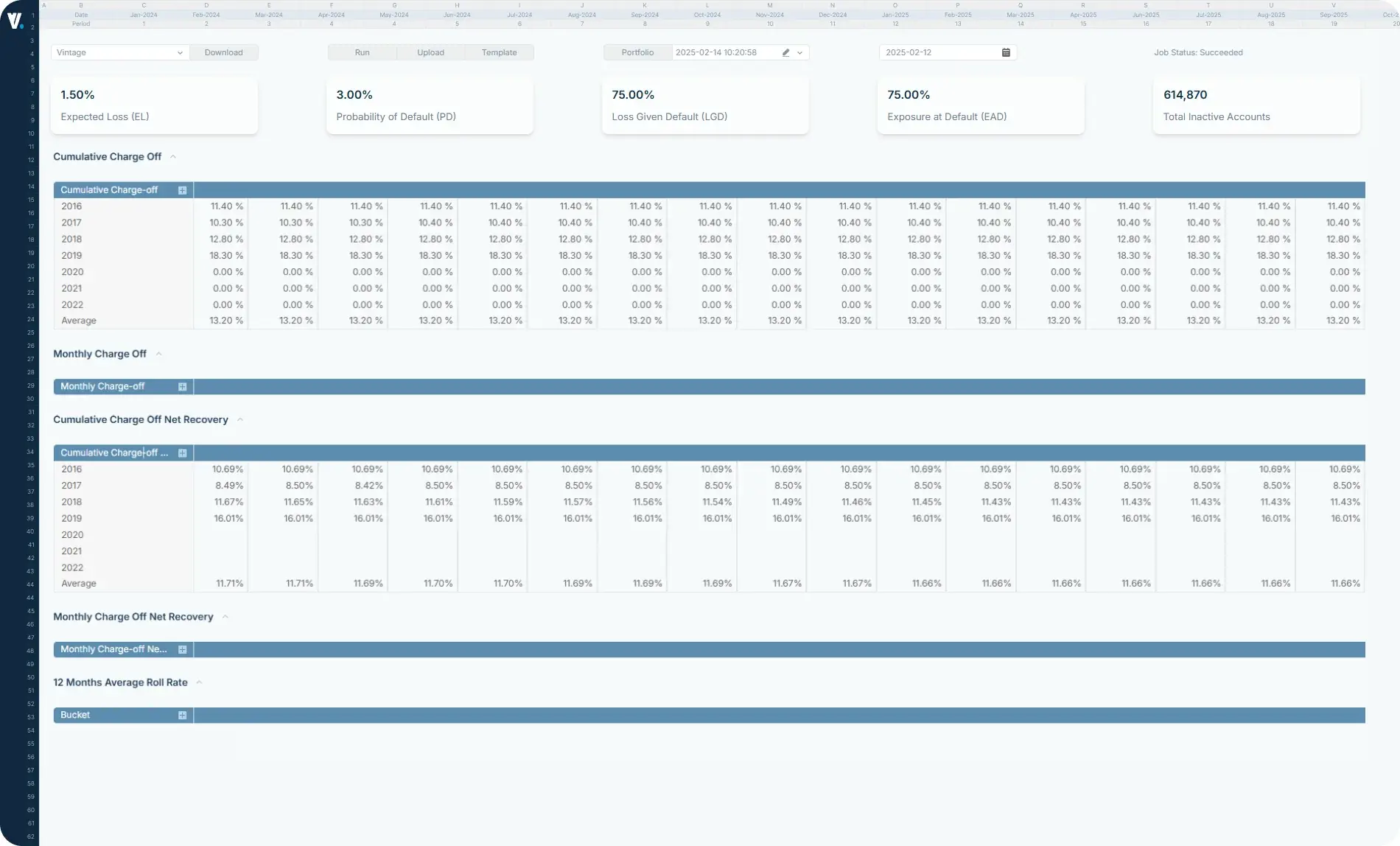

Advanced Risk Modeling, Portfolio Analysis, And Predictive Analytics For Comprehensive Credit Risk Management

Instant Cohort Analysis

Track performance by vintage with one click

Automated Forecasting

Predict future losses using historical patterns

Stress Testing

Model scenarios in base, stress, and worst cases

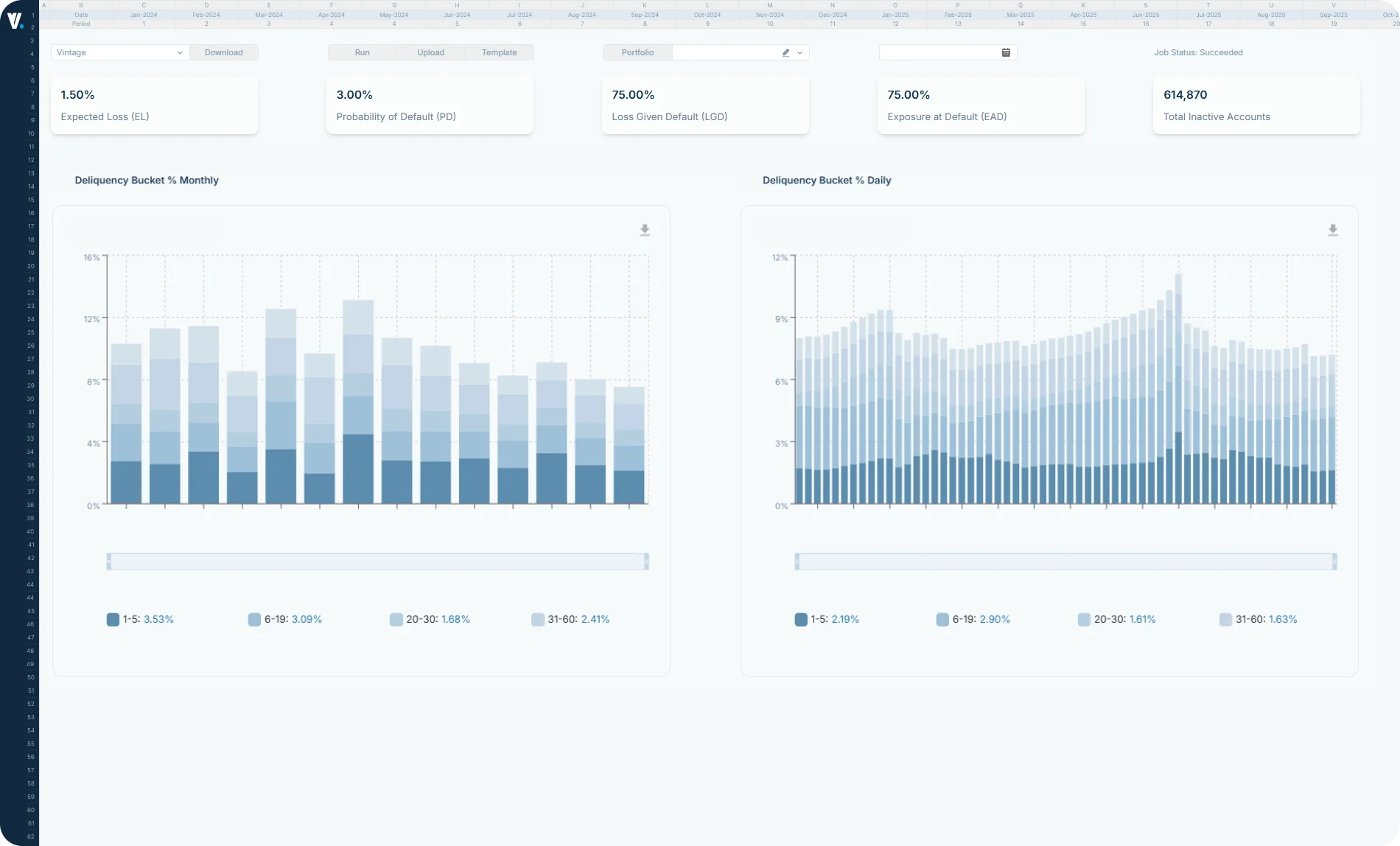

Visual Dashboards

Interactive charts and tables for deep insights

Transform Your Credit Loss Management

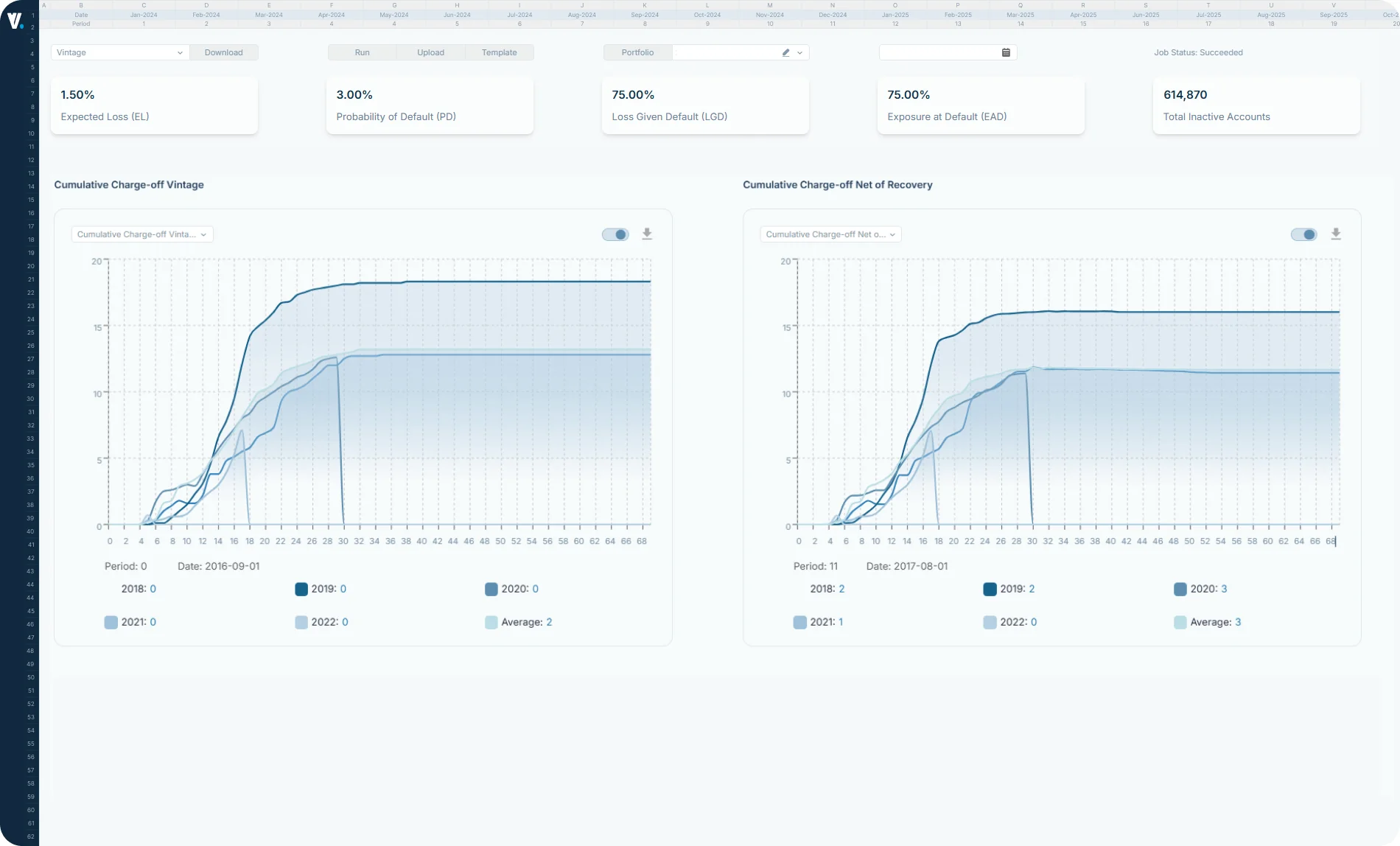

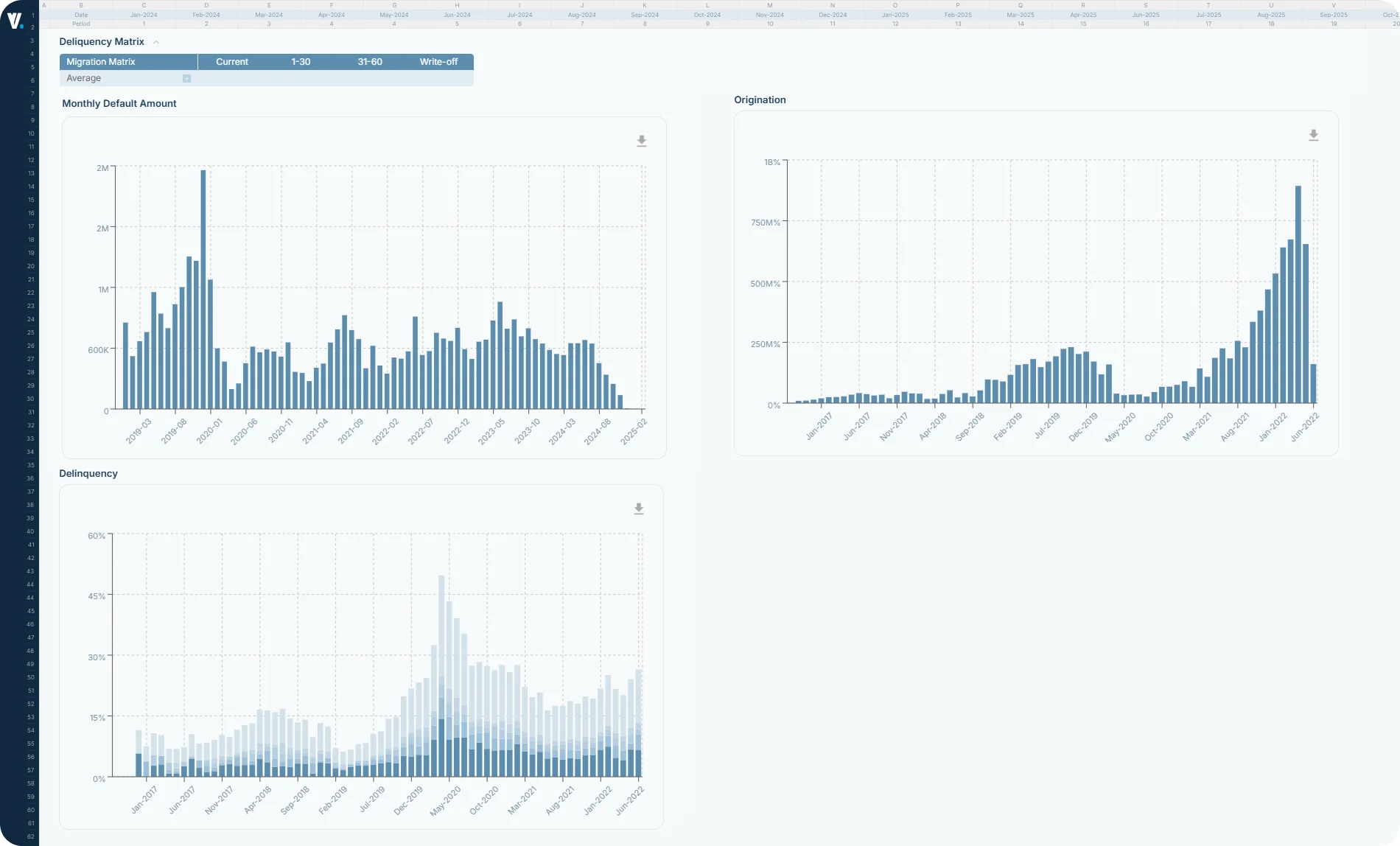

Static loss analysis provides a powerful framework for understanding portfolio performance over time. By tracking cohorts from origination through their lifecycle, you gain unprecedented visibility into loss patterns, enabling proactive risk management and strategic decision-making.

Enhanced Forecasting Accuracy

Predict future losses with precision using historical cohort data, improving financial planning and reserve adequacy.

Strategic Portfolio Optimization

Identify high-performing vintages and underwriting criteria to optimize future originations and maximize profitability.

Proactive Risk Management

Detect early warning signs by comparing actual vs. expected loss curves, enabling timely intervention and mitigation strategies.

Regulatory Confidence

Demonstrate robust loss forecasting capabilities to regulators with comprehensive historical analysis and stress testing.

Data-Driven Pricing Strategies

Set competitive yet profitable pricing based on true loss expectations derived from actual portfolio performance.

Improved Capital Efficiency

Optimize capital allocation by understanding true loss exposure across different portfolio segments and vintages.