Financial Planning & Analysis

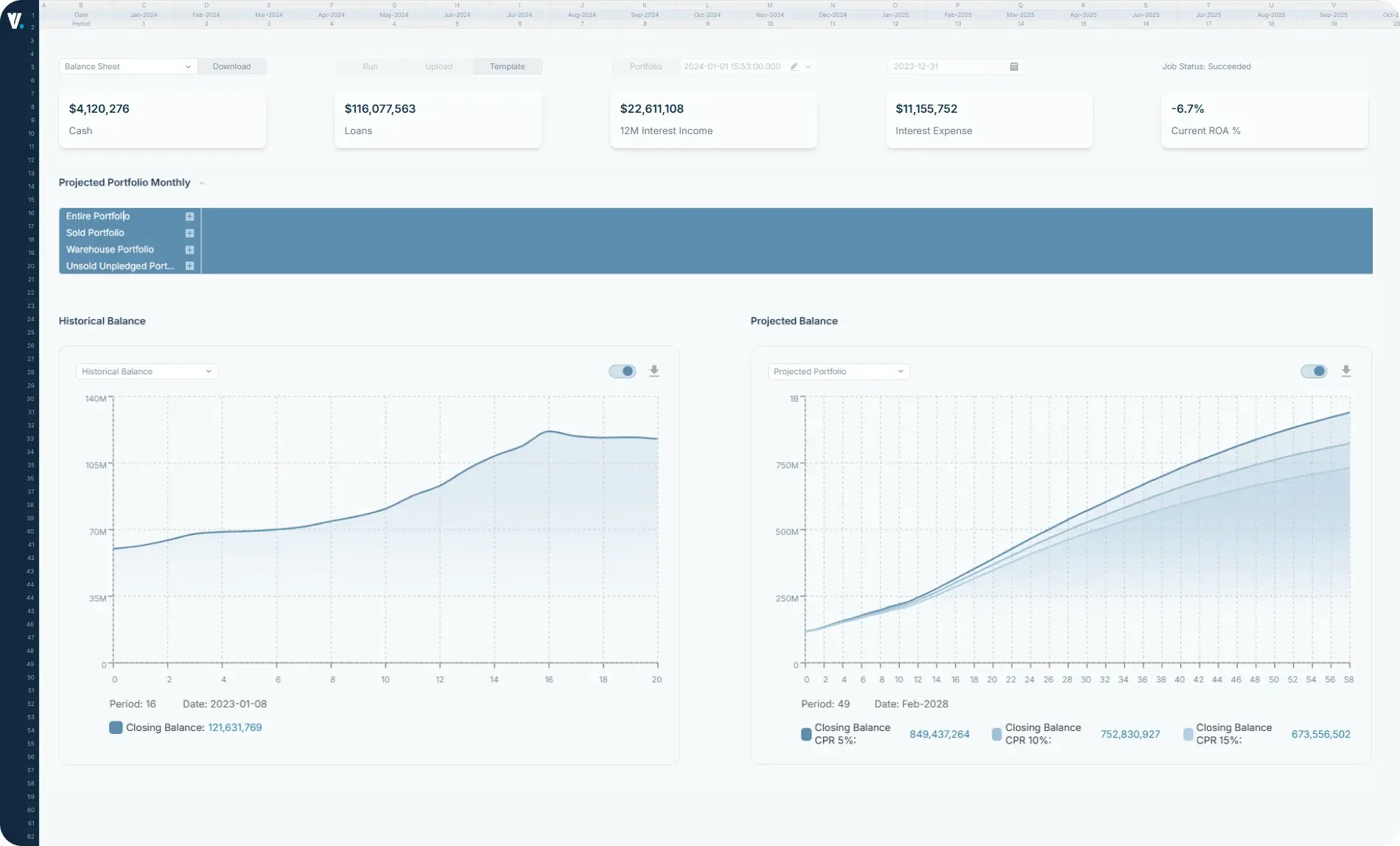

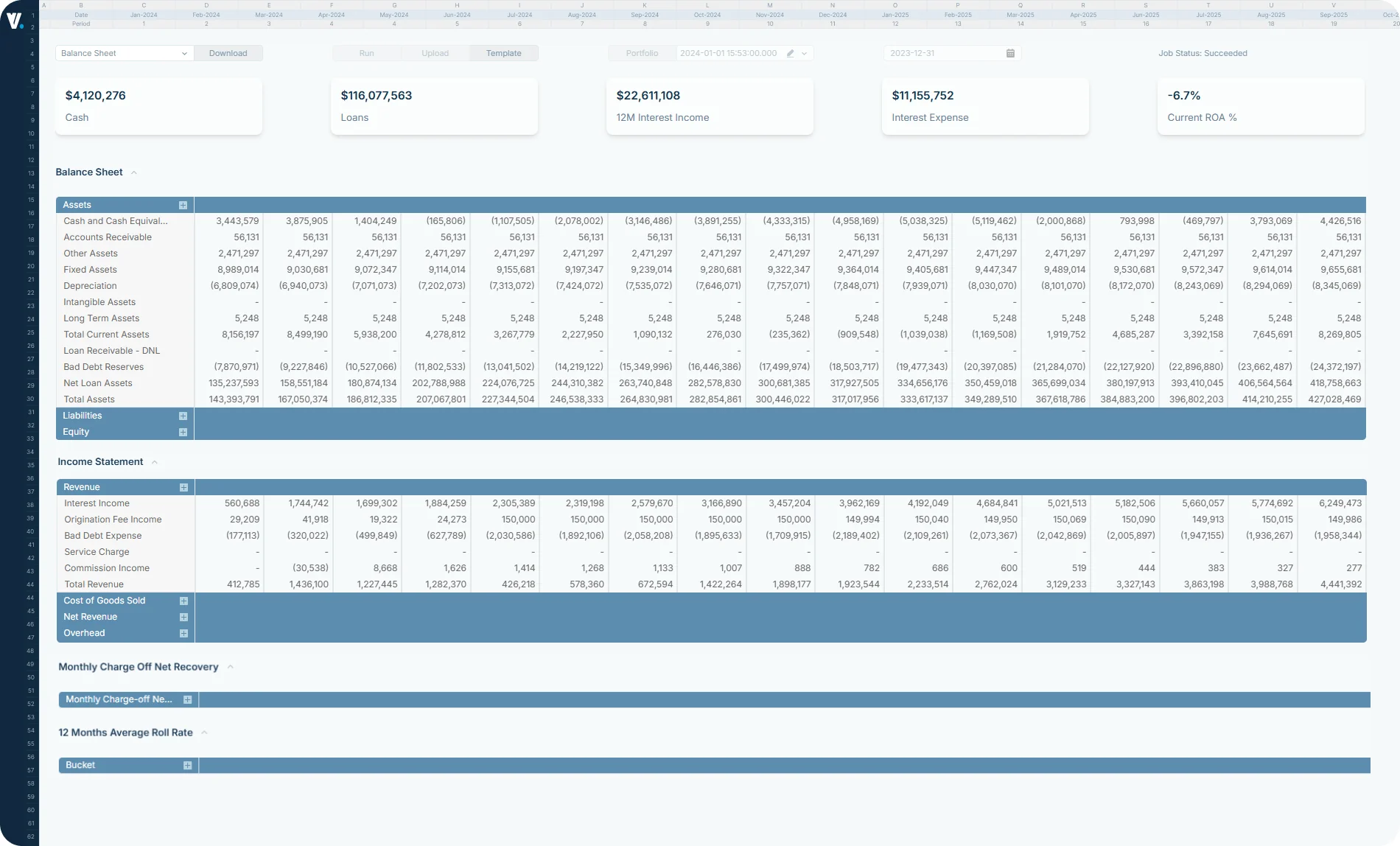

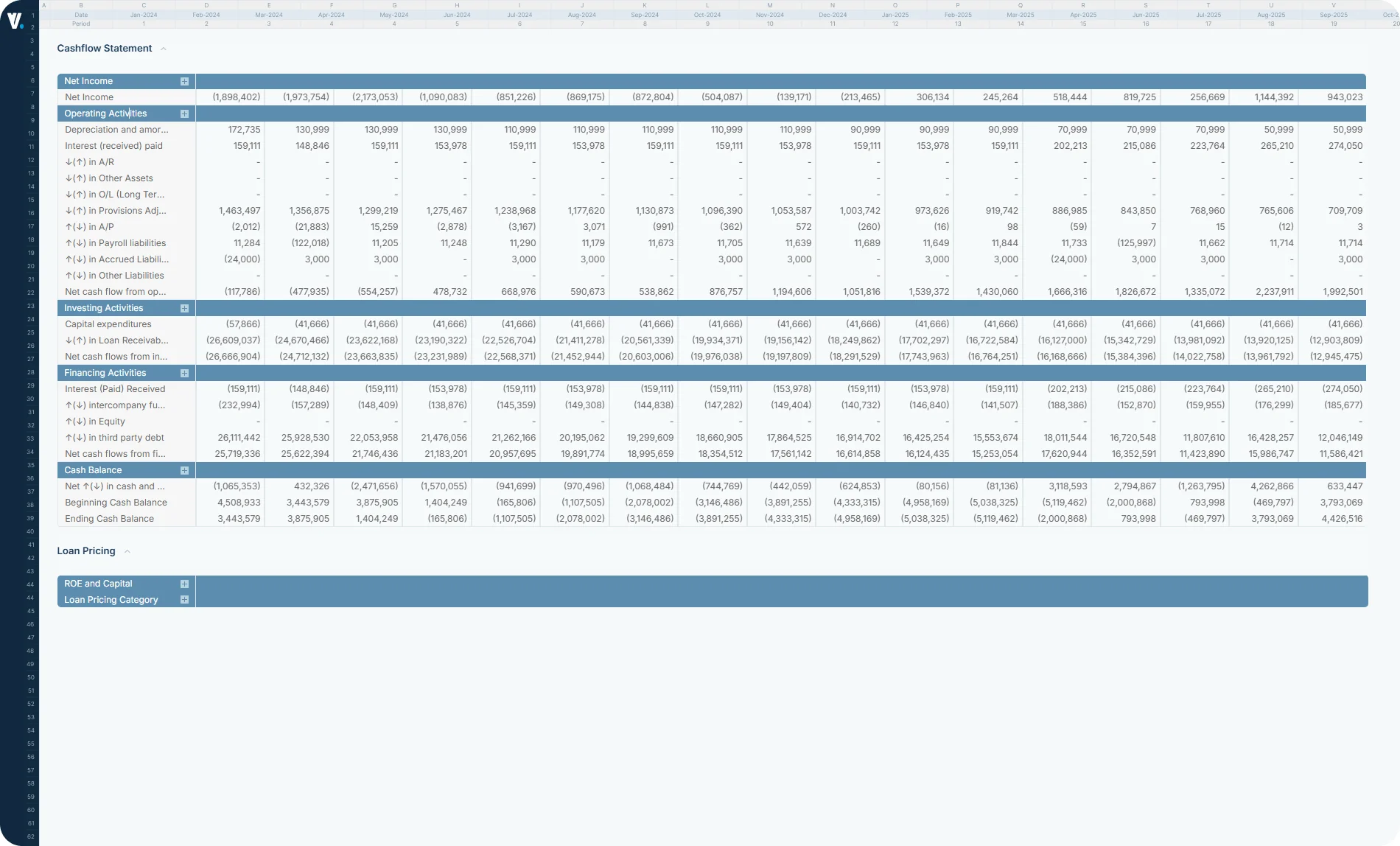

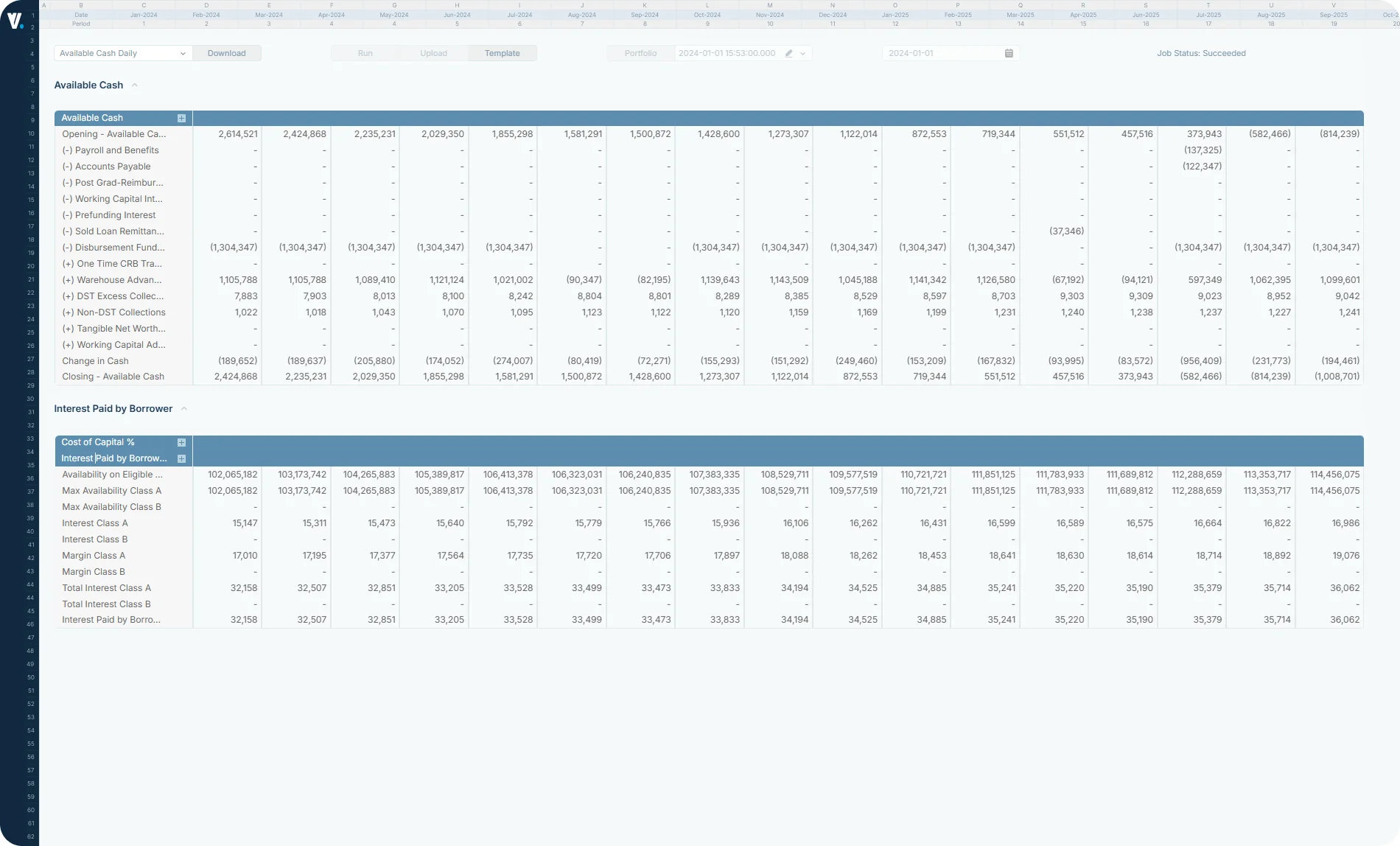

Advanced FP&A tool that generates 5-year projected balance sheets and income statements for enhanced decision-making. Provides cash flow projections with loan-level amortization and models interest income based on user-defined stress scenarios.

FP&A Features

Comprehensive Tools And Analytics For Enhanced Profitability, Capital Efficiency, And Strategic Decision-Making

Integrated 3-Statement Model

Fully linked income, balance, and cash flow

60-Period Forecasting

Extended horizon for strategic planning

Real-Time Calculations

Instant updates across all statements

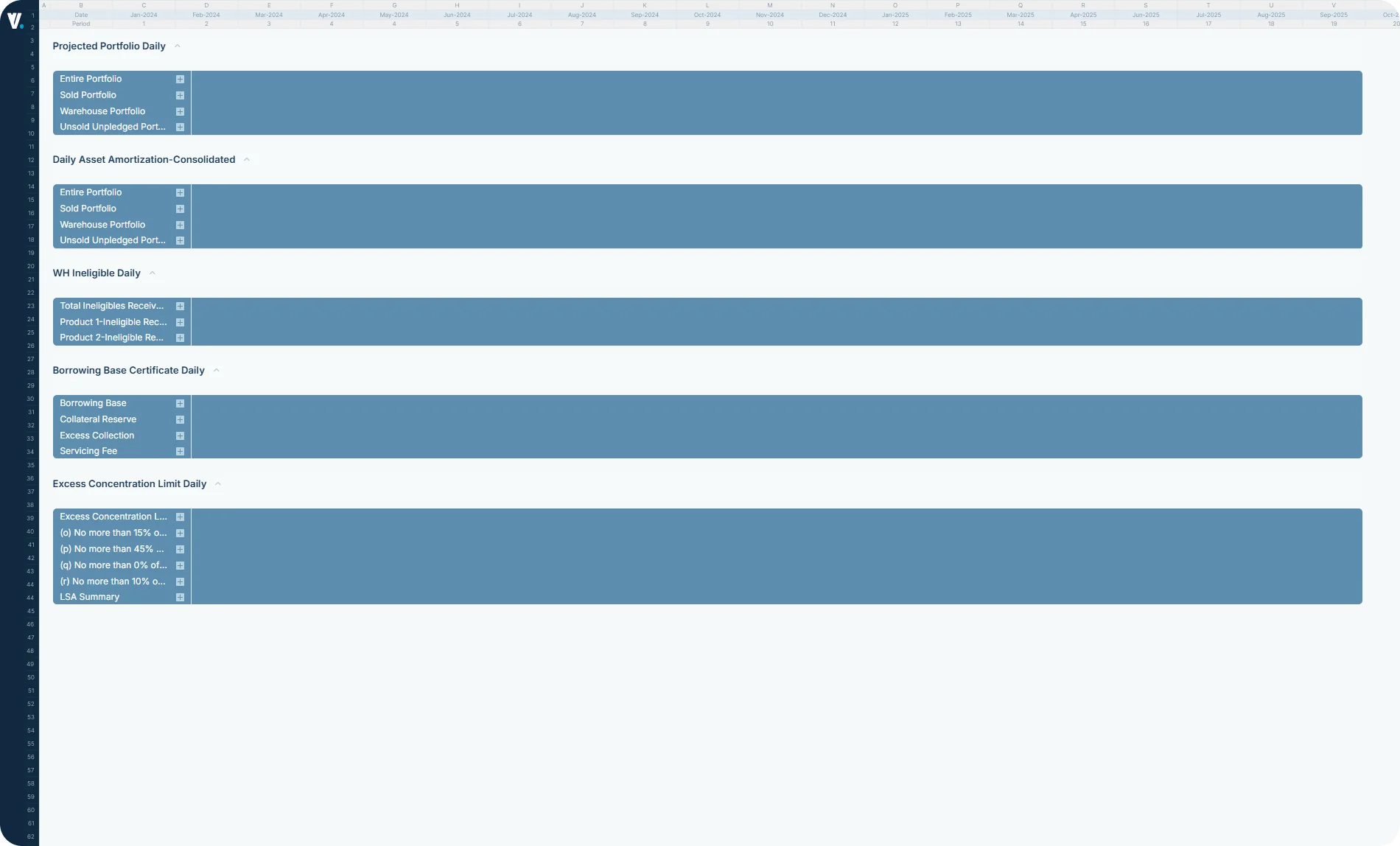

Visual Analytics

Interactive charts and trend analysis

Power Your Financial Planning with Complete Visibility

Three-statement financial projections provide the foundation for strategic planning, capital allocation, and performance tracking. Our integrated modeling approach ensures consistency across income, balance sheet, and cash flow statements while automating complex calculations and interdependencies.

Accelerated Planning Cycles

Reduce budgeting and forecasting time by 70% with automated calculations and scenario modeling.

Improved Accuracy

Eliminate manual errors and ensure consistency across all financial statements with integrated data flow.

Strategic Decision Support

Make informed capital allocation and investment decisions with comprehensive financial projections.

Enhanced Stakeholder Communication

Present clear, professional financial forecasts to boards, investors, and management teams.

Regulatory Readiness

Maintain audit-ready documentation and support compliance reporting requirements.

Scalable Infrastructure

Handle growing complexity and data volumes without sacrificing performance or accuracy.